22 Stackelberg

For more information on these topics, see Allen, Doherty, Weigelt, and Mansfield Chapter 11: Oligopoly.

22.1 Classwork 22: Stackelberg Competition

Stackelberg competition provides a model of how firms compete when one company has the advantage of moving first. Unlike Cournot competition where firms make decisions simultaneously, Stackelberg competition captures the dynamics of sequential decision-making - where one firm (the leader) makes its choice before other firms (the followers) respond.

The key insight of Stackelberg competition is that the first-mover advantage allows the leader to commit to a strategic position, forcing followers to adapt to that reality rather than choose independently. The leader essentially gets to “stake out their territory” first, knowing that followers must then optimize their decisions given what the leader has already done.

Example

Consider a simple market with linear demand \(P = 100 - Q\), where \(Q = Q_1 + Q_2\) (leader and follower quantities). Both firms have the total cost function \(TC = 20Q_1\) or \(20Q_2\).

The solution process works backward:

- First, determine the follower’s (Firm 2’s) optimal response function:

- Follower profit: \(\pi_2 = P \times Q_2 - TC= (100 - Q_1 - Q_2)Q_2 - 20Q_2\)

- Maximize with respect to \(Q_2\): \(\frac{\partial \pi}{\partial Q_2} = 0 = 100 - Q_1 - 2 Q_2 - 20\)

- Solve for \(Q_2\) to get Firm 2’s response function: \(Q_2 = 40 - 0.5Q_1\)

- Leader incorporates this response:

- Leader profit: \(\pi_1 = P \times Q_1 - TC = (100 - Q_1 - Q_2) Q_1 - 20 Q_1\)

- Incorporate the fact that Firm 1 anticipates Firm 2’s response function (substitute \(Q_2 = 40 - 0.5Q_1\)): \(\pi_1 = (100 - Q_1 - 40 + 0.5 Q_1) Q_1 - 20 Q_1\)

- Simplify: \(\pi_1 = 40 Q_1 - 0.5 Q_1^2\)

- Maximize: \(\frac{\partial \pi_1}{\partial Q_1} = 0 = 40 - Q_1\)

- Firm 1’s optimal choice: \(Q_1 = 40\)

- Solve for follower quantity according to their response function:

- \(Q_2 = 40 - 0.5Q_1 = 40 - 0.5 (40) = 40 - 20 = 20\).

The equilibrium under Stackelberg Competition has the leader producing 40 units and the follower 20 units, with a market price of $40.

Classwork Problems

Basic Linear Demand

Consider a simple market with linear demand \(P = 120 - Q\), where \(Q = Q_1 + Q_2\) (leader and follower quantities). Both firms have the total cost function \(TC = 30Q_1\) or \(30Q_2\).

Determine the follower’s (Firm 2’s) optimal response function by maximizing their profit given any \(Q_1\).

Write down the leader’s (\(Q_1\)’s profit) and incorporate their anticipation of \(Q_2\). Show that when Firm 1 profit maximizes, they choose \(Q_1 = 45\).

Solve for Firm 2’s follower quantity according to their response function.

Fill in the blanks: The equilibrium under Stackelberg Competition has:

- Leader producing ___ units

- Follower producing ___ units

- Total market quantity = ___ units

- Market price = ___

- Leader’s profit = ___

- Follower’s profit = ___

This example shows how the leader’s first-mover advantage results in twice the output and profit of the follower, while still maintaining a price well above marginal cost.

Differentiated Products

Let’s add product differentiation to see how it affects the dynamics. Consider demand functions:

\(P_1 = 100 - 2Q_1 - Q_2\)

\(P_2 = 100 - 2 Q_2 - Q_1\)

Firm 1 produces \(Q_1\) units of good 1 and Firm 2 produces \(Q_2\) units of good 2. The two goods sell at different prices, but the amount the other firm produces effects their rival’s prices.

Let firm total costs be \(TC = 20 Q_1\) or \(20 Q_2\).

Write down the follower’s (Firm 2’s) profit function and maximize it to show that the follower’s response function is \(Q_2 = 20 - 0.25 Q_1\).

Write down the leader’s (Firm 1’s) profit function and use the fact that Firm 1 can anticipate Firm 2’s response function to show that Firm 1 will choose \(Q_1 = 17.14\).

Calculate the follower’s quantity.

This example shows that product differentiation reduces the leader’s quantity advantage because products aren’t perfect substitutes.

Asymmetric Costs

Let’s examine how cost differences affect the equilibrium. Return to homogeneous products but with:

- Leader \(TC = 20Q_1\)

- Follower \(TC = 30 Q_2\)

Let demand be given by \(P = 100 - Q_1 - Q_2\).

Write down the follower’s (Firm 2’s) profit function and maximize it to show that the follower’s response function is \(Q_2 = 35 - 0.5 Q_1\).

Write down the leader’s (Firm 1’s) profit function, suppose Firm 1 anticipates Firm 2’s response function, and maximize the leader’s profit to show \(Q_1 = 45\).

Find the follower’s quantity.

The lesson: the cost advantage amplifies the leader’s quantity advantage.

22.2 Historical Context: Cournot, Bertrand, and Stackelberg

Antoine Augustin Cournot (1801-1877)

The story begins with Antoine Augustin Cournot, a French professor of mathematics, who revolutionized economics by introducing mathematical analysis to the field, though his contributions went largely unrecognized during his lifetime. In his 1838 work “Researches into the Mathematical Principles of the Theory of Wealth,” Cournot explored how monopolists and duopolists behave in markets:

Suppose that a man finds himself proprietor of a mineral spring which has just been found to possess salutary properties possessed by no other. He could doubtless fix the price of a liter of this water at 100 francs; but he would soon see by the scant demand, that this is not the way to make the most of his property. He will therefore successively reduce the price of the liter to the point which will give him the greatest possible profit.

He showed how a monopolist with a unique mineral spring would need to gradually lower prices to maximize profits, as excessive prices would severely reduce demand. In analyzing duopoly, he made the crucial observation that identical products must sell at the same market price, leading to his theory of how market demand would be split between competing producers.

Cournot developed fundamental economic principles about profit maximization, price competition, market demand, and strategic interdependence between firms. He also advanced demand theory by expressing mathematically what earlier economists like Adam Smith had described only intuitively. As James W. Friedman later observed in his article The legacy of Augustin Cournot (2000), “Just as Adam Smith vaguely perceived the demand function but could not actually see it, Cournot vaguely perceived the Nash equilibrium, but did not quite see it.”

Joseph Louis François Bertrand (1822-1900)

In 1883, six years after Cournot’s death, Joseph Bertrand (another French mathematician, also famous for his work on number theory, probability, and thermodynamics) wrote a review of Cournot’s work on oligopoly. Bertrand’s review was exceptionally unforgiving - he famously claimed that “removing the symbols would reduce the book to just a few pages”. Multiple sources suggest he may not have thoroughly read or fully understood the economic aspects of the works he was reviewing. As Vilfredo Pareto later wrote, “he wrote his article without looking at the books of the authors he criticized”.

Yet ironically, Bertrand’s critique led to what we now know as “Bertrand competition,” though he never intended to create an alternative model. His observation that firms would naturally compete on price rather than quantity, though presented as a criticism, became the foundation for a new way of thinking about competition.

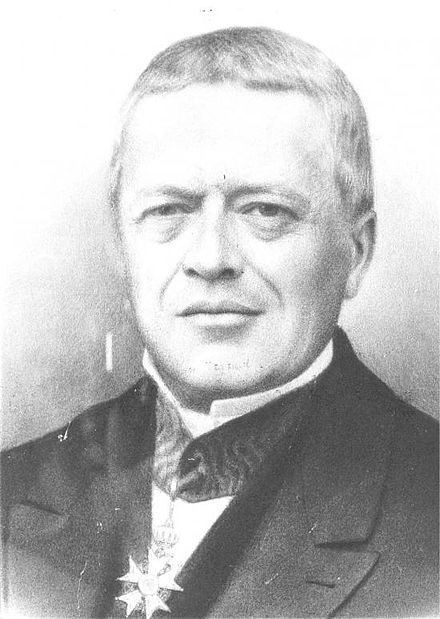

Heinrich von Stackelberg (1905-1946)

Heinrich von Stackelberg’s life was marked by both academic brilliance and historical turbulence. Born into a Baltic German noble family in Moscow, he was forced to flee during the Russian Revolution, eventually finding refuge in Germany. He pursued his education at the University of Cologne, studying economics and mathematics before earning his PhD in 1930.

His doctoral dissertation was on cost theory, published in 1932 as “Fundamentals of a Pure Cost Theory.” This work quickly established his reputation in the field. His most influential contribution came in 1934 with the publication of “Marktform und Gleichgewicht” (Market Structure and Equilibrium), which built upon and responded to earlier oligopoly theories, including the work of Cournot, Bertrand, and Edgeworth.

Stackelberg’s personal life was complicated by his early involvement with the Nazi Party, which he joined in 1931, becoming an SS sergeant in 1932. However, he grew increasingly disillusioned with the regime, particularly due to conflicts with his Protestant faith. He made two unsuccessful attempts to leave the SS and used his party connections to help Jewish colleagues and others persecuted by the regime. By the early 1940s, Nazi internal reports considered him an “obstacle” to their university policies. Throughout this period, he was known for carefully separating his scientific work from political ideology and maintained connections with anti-Nazi aristocrats and academics.

In 1943, Stackelberg relocated to Spain and continued to teach at the Complutense University of Madrid. Tragically, his life was cut short by lymphoma in 1946 at the age of 40.

Modern Applications of Classic Oligopoly Models

The fundamental insights from Cournot, Bertrand, and Stackelberg continue to illuminate modern economic challenges. In digital markets, platform competition often follows Stackelberg patterns, with established firms like Amazon or Google acting as leaders while smaller platforms follow. While Bertrand’s price competition model seems especially relevant as automated pricing algorithms enable instant price adjustments, these same algorithms sometimes facilitate tacit collusion (Calvano et al., 2020).

Environmental policy and cybersecurity provide fascinating real-world applications of Stackelberg principles. For instance, Baron (1985) examines acid rain regulation where Midwestern coal plants create pollution that affects the Northeast and Canada. By acting as a Stackelberg leader, the EPA can set strict pollution standards first, knowing that utility commissions will have to follow by raising electricity prices on Midwestern consumers. This strategic sequencing helps address the environmental externality.

Similarly, in cybersecurity, Brown et al. (2006) show how defenders and attackers interact in a classic Stackelberg game: defenders must move first to protect infrastructure, while attackers observe these defenses and plan their optimal response. The authors demonstrate that this sequential nature of defense and attack, combined with attackers’ ability to gather detailed information about defensive preparations, makes Stackelberg models ideal for analyzing system vulnerabilities and planning protective measures.

Laboratory experiments have largely validated these models’ key predictions: Bertrand price competition drives prices toward marginal cost with three or four players, but not two (Dufwenberg and Gneezy, 2000). Cournot quantity competition leads to more moderate competition (Normann and Oechssler, 2004). Stackelberg’s predicted first-mover advantages are regularly observed (Huck and Müller, 2000). However, experiments also reveal important behavioral factors like fairness concerns that the original models don’t capture.

22.3 Practice Questions