library(tidyverse)4.3 Taxes

Taxes generate revenue that funds essential services like public education, healthcare, infrastructure, national defense, and social welfare programs. However, when the government taxes a market, no matter if it’s a tax on buyers or if it’s a tax on sellers (like through sales taxes, income and payroll taxes, taxes on investments, or real estate taxes) it raises the price consumers pay and reduces the price sellers receive.

As a result, consumers buy less due to higher prices, and sellers are less willing to supply due to lower profits. This leads to a decrease in the quantity of goods or services exchanged in that market. This effect is exacerbated when either supply or demand is very elastic (when suppliers or demanders can easily escape to alternative markets).

Effects of a Tax

Consider supply given by \(p = \frac{q}{100}\) and demand given by \(p = 4.5 - \frac{q}{200}\).

- Use ggplot and stat_function to plot both supply and demand on one graph.

- Find the intersection (the equilibrium price and quantity exchanged in the market), and show your algebra.

- Calculate the total surplus: the total gains from trade, as the sum of the consumer surplus (area under the demand curve and above the price, out to the quantity exchanged), and the producer surplus (area under the price and above the supply curve, out to the quantity exchanged).

Answer:

- Continuing from question 1, suppose the government imposes a $1.50 per unit tax on the market. You can model this as a $1.50 tax wedge: a wedge with height = 1.5 that goes between the supply and demand curves.

- Find the new equilibrium price and quantity exchanged in the market. There will actually be two prices: the price buyers pay and the price sellers receive. The difference between the two prices should be 1.5: the size of the tax per unit sold. You can answer this question by visual inspection of the plot from 1a: where is the difference between supply and demand equal to 1.5, to the left of the intersection?

- Who bears most of the tax burden: buyers or sellers? That is, does the price buyers pay rise more than the price sellers receive falls, or is it the other way around?

- Calculate the government’s tax revenue from this market: the tax size times the quantity exchanged.

- Calculate the total surplus in the market after the tax is imposed as the sum of the consumer’s surplus, producer’s surplus, and tax revenue.

- By how much does total surplus fall after the tax is imposed on the market? This represents the gains from trade that are not realized because the tax increases prices for buyers and decreases prices for sellers.

Answer:

- Elasticity and Tax Burden

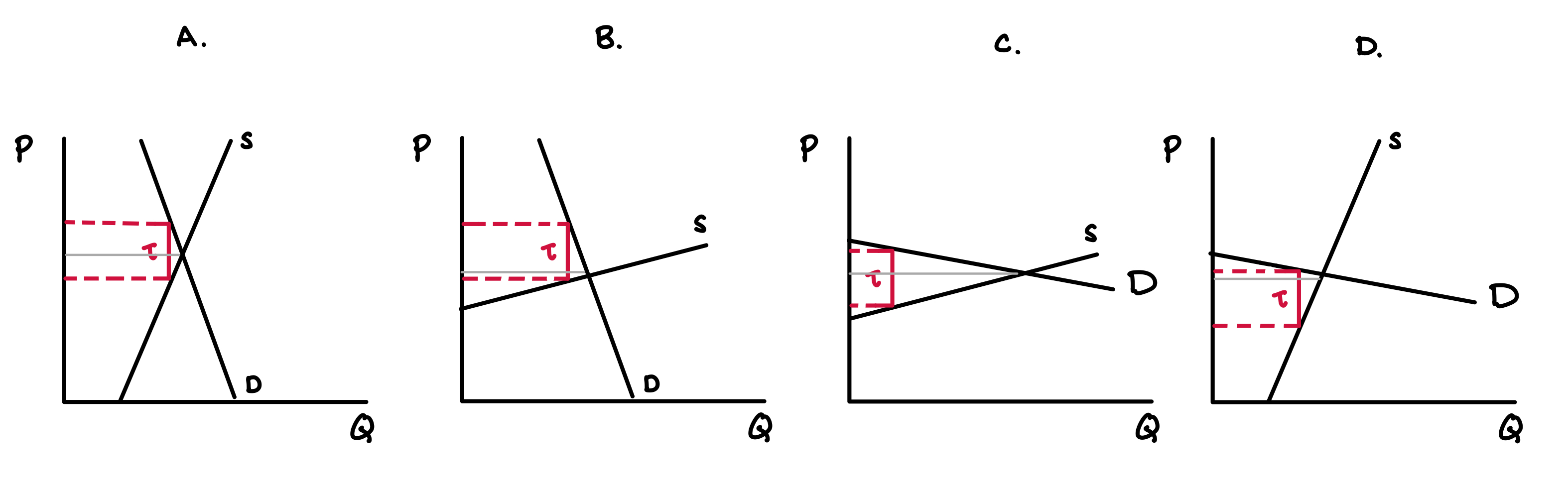

In the image provided above, analyze scenarios A-D and determine the following for each:

- Whether supply or demand is elastic or inelastic.

- Which side of the market (supply or demand) bears the majority of the tax burden.

Fill in the blanks: the more (elastic/inelastic) side of the market always bears the tax burden because they (can/can’t) easily escape the market when the price changes.

Fill in the blanks: when both sides of the market is elastic, quantity exchanged falls by a (little/lot), so there is a (little/lot of) dead weight loss from the tax.

Answers:

- One way governments have tried to collect taxes from the wealthy is through the use of luxury taxes, which are exactly what they sound like: taxes on goods that are considered luxuries, like jewelry or expensive cars and real estate. The problem is that the demand for luxuries is very elastic. Is a luxury tax more likely to hurt the buyers of jewelry, or the sellers of jewelry?

Answer:

- Let’s apply the economics of taxation to romantic relationships. Sometimes relationships have taxes. Suppose that you and your boyfriend or girlfriend live one hour apart. Using the tools developed in the chapter, how can you predict which one of you will do most of the driving? That is, which one of you will bear the majority of the relationship tax?

- The person with more inelastic demand for the relationship will bear the tax – he or she will do most of the driving.

- The person with more elastic demand for the relationship will bear the tax – he or she will do most of the driving.

Answer:

- Decades ago, Washington, DC, a fairly small city, wanted to raise more revenue by increasing the gas tax. Washington, DC, shares borders with Maryland and Virginia, and it’s very easy to cross the borders between these states. How elastic is the demand for gasoline sold at stations within Washington, DC? In other words, if the price of gas in DC rises, but the price in Maryland and Virginia stays the same, will gasoline sales at DC stations fall a little, or will they fall a lot?

- Elastic – gasoline sales would fall a lot

- Inelastic – gasoline sales would fall a little

Answer:

- Given your answer on the previous question, how much revenue did it raise when it increased its gasoline tax?

- A little revenue

- A lot of revenue

Answer:

- If DC, Maryland, and Virginia all agreed to raise their gas tax simultaneously, how much revenue could the gas tax raise? Note: These states have heavily populated borders with each other, but they don’t have any heavily populated borders with other states.

- A little revenue

- A lot of revenue

Answer:

- Suppose that Maria is willing to pay $40 for a haircut, and her stylist Juan is willing to accept as little as $25 for a haircut. What possible price for the haircut would be beneficial to both Maria and Juan?

- $20

- $30

- $45

Answer:

- Given that Maria and Juan find a price suitable to both of them, how much total surplus (i.e., the sum of consumer and producer surplus) would be generated?

- $15

- $30

- $10

Answer:

- Suppose that Maria is willing to pay $40 for a haircut, and her stylist Juan is willing to accept as little as $25 for a haircut. If the government imposes a $20 haircut tax, will the haircut transaction still happen?

- Yes

- No

Answer: